September 17, 2020

Intersection of Litigation Finance and Patent Litigation

By Trey Hebert

Trey Hebert of Permentum Capital provided his insights for an article prepared in tandem with Ed Truant, of Slingshot Capital. The article is available at the Litigation Finance Journal, and Trey's excerpt is below.

Although many litigation funders were historically hesitant to invest in patent litigation, there are signs that patent litigation is becoming an attractive case type for litigation finance. Such signs include changes in the law, increased patent-litigation filings, and patent-friendly rules in certain jurisdictions. Below we provide context for patent disputes, review how certain judicial and legislative events made patent litigation riskier and less profitable, and highlight signs of change in patent litigation. This article then presents successful examples of third-party funding in patent litigation and offers insights from investors, before discussing the future of litigation funding in the patent arena.

I. Patent Disputes & Patent Trolls

Patents have long held a special position in U.S. litigation. Though rarely discussed, patent protection has its roots in Article I of the U.S. Constitution. Because patent protection is federal in nature, all patent cases are heard in federal court. Generically, patent disputes involve a fight between parties over the exclusive right to a patented invention.

A non-practicing entity (NPE)—often pejoratively referred to as a patent troll—is an entity that does not itself employ an invention, but nevertheless uses the patent to extract licensing fees. One of the earliest well-known examples of NPE patent assertion was by renowned inventor Eli Whitney in connection with his famous cotton gin invention, patented in 1794. After his own attempts to commercialize the cotton gin failed, Mr. Whitney sued plantation owners that had started using his patented invention. While Mr. Whitney ultimately recovered little for his patent assertion efforts, his case showed future litigants that a plaintiff’s use of a patent was not a prerequisite.

In some respects, patent lawsuits brought by NPEs are a type of litigation finance. After all, litigation finance uses current capital to obtain a future financial benefit through litigation. Likewise, an NPE or patent troll spends current capital on acquiring and asserting patent rights for the future financial benefit of court awards or licensing fees.

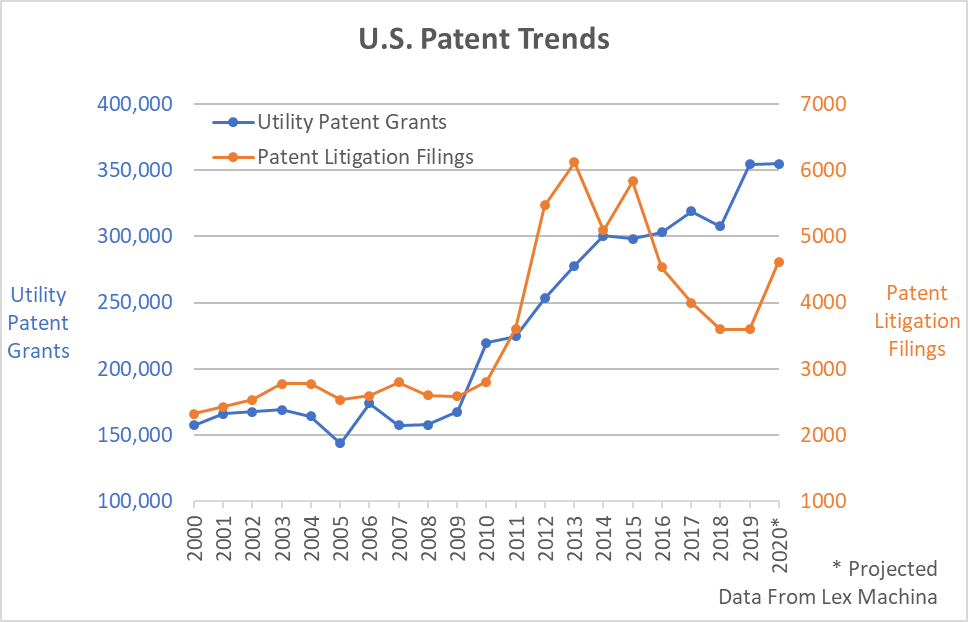

The number of lawsuits filed by NPEs grew in the wake of the 2001 and 2008 recessions. As the tech bubble burst and companies folded, many businesses holding patents failed, and their patents were snapped up at bargain prices by patent-holding companies. A few years later, those patents were being litigated.

Suits brought by NPEs tend to be a breed apart. Traditional defense strategies such as filing counterclaims and employing cost-increasing litigation tactics, such as conducting burdensome discovery, are generally ineffective against NPEs. By-definition, NPEs are unlikely to have committed any bad acts and are often formed as shell companies with few documents or employees. And they don’t face the same type of public-relations issues that customer-facing companies might need to consider.

II. The Patent-Dispute Landscape

As the number of NPE suits increased, the judiciary and Congress responded. Several judicial and legislative changes made patent litigation longer and more difficult, increasing the risk and decreasing the profitability.

eBay

In 2006, the U.S. Supreme Court in eBay Inc. v. MercExchange, L.L.C. held that a successful patent plaintiff was not guaranteed the right to a permanent injunction against the losing defender. Prior to this decision, courts would almost always issue permanent injunctions against patent infringers. The threat of an injunction likely forced earlier and higher settlements. eBay didn’t completely kill the injunction, but it undoubtedly devalued patent litigation.

America Invents Act

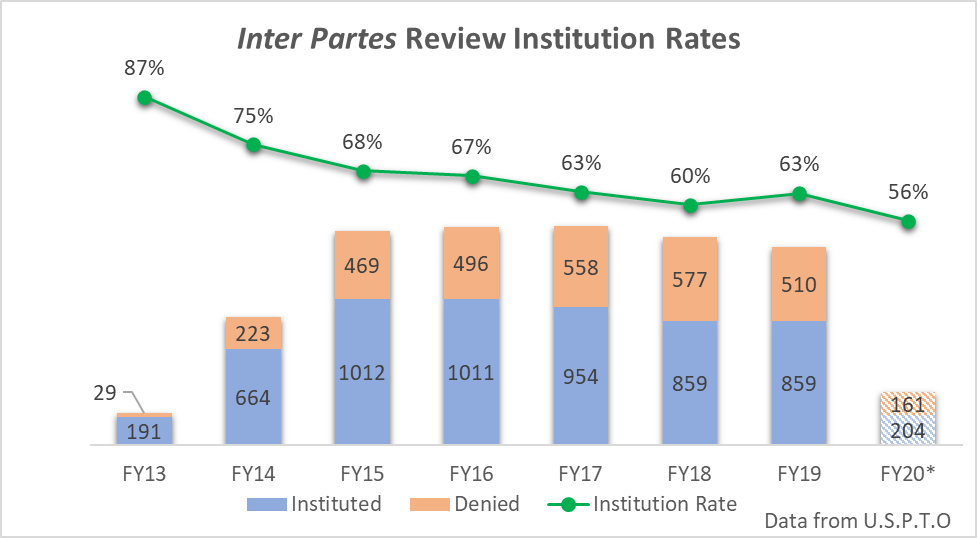

The America Invents Act of 2011 was the most significant statutory overhaul of the U.S. patent system in half a century. Perhaps most impactful, Congress expanded the process to invalidate a patent through Inter Partes Review (“IPR”) before a Patent Trial and Appeal Board (“PTAB”). An IPR is now commonly used by lawsuit defendants to challenge the validity of the patents asserted against them. District courts regularly pause litigation while the PTAB resolves the IPR. Because few patents survived early IPR—Federal Circuit Chief Judge Rader famously referred to the PTAB as “death squads killing property rights”—IPR is a favorite mechanism for defendants to either end litigation early or increase costs and delay resolution.

Alice

In 2014, the U.S. Supreme Court’s decision in Alice Corp. v. CLS Bank changed how courts analyzed patent validity, encouraging defendants to seek an early ruling that asserted patents were invalid. In Alice’s wake, defendants began to routinely ask courts to kill patents, arguing that they were concerned non-patentable, abstract ideas, and waves of patents were invalidated early in litigation. Plaintiffs, therefore, faced greater uncertainty, and defendants capitalized on the ability to attempt a relatively cheap escape maneuver prior to expensive discovery.

TC Heartland

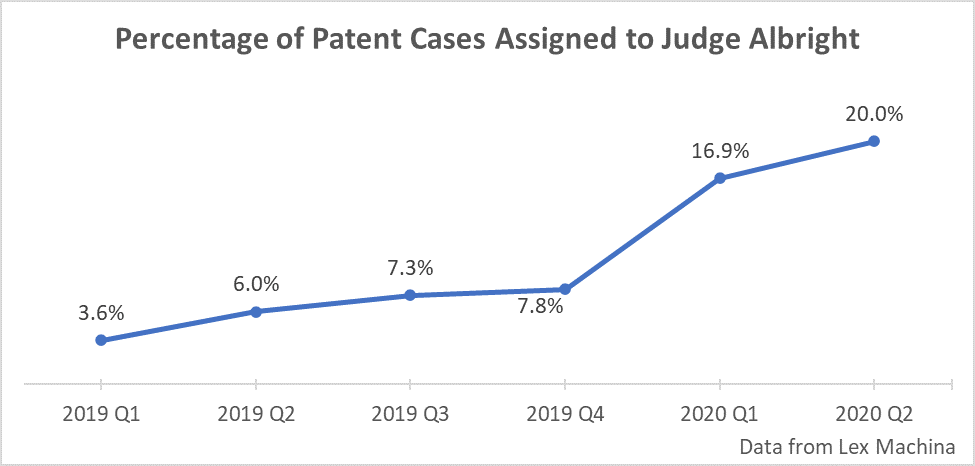

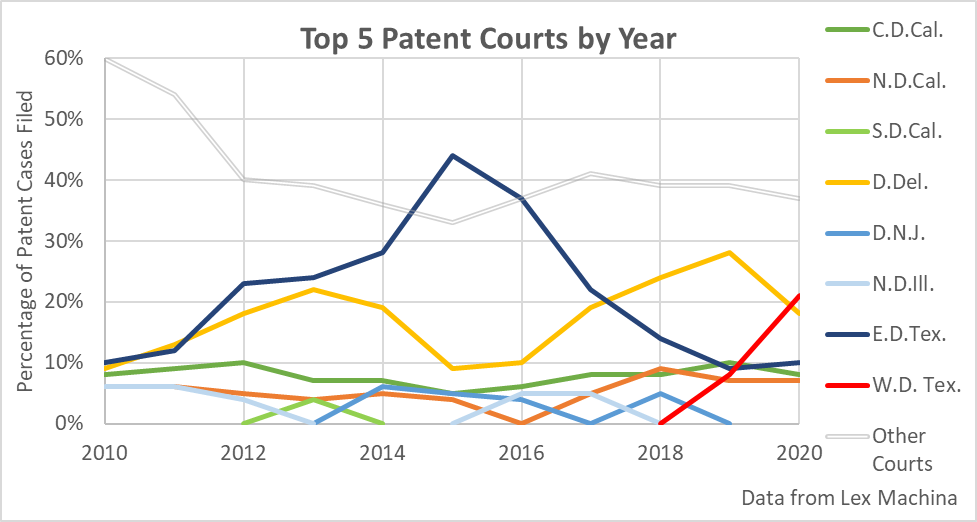

In 2017, in TC Heartland LLC v. Kraft Foods Group Brands LLC, the U.S. Supreme curtailed the places that a corporate defendant could be sued: venue is only proper in the district where (1) a defendant is incorporated or (2) has a regular, established place of business and committed acts of infringement. Before TC Heartland, the Eastern District of Texas (EDTX) was the favorite watering-hole of patent plaintiffs, because it offered high damages awards and a “rocket docket” to trial. TC Heartland gutted EDTX’s hold on patent litigation, increasing uncertainty in the short term, as plaintiffs were forced to try new venues.

III. Signs of Change: Fertile Ground for Litigation Finance

Many funders have traditionally shied away from patent litigation, citing its expense, difficulty, risk, and duration. But analysis reveals that these alleged drawbacks are either less pronounced than anticipated, or are changing.

IV. Successful Examples of Third-Party Funding for Patent Litigation

UC Santa Barbara LED Filament Campaign

UC Santa Barbara is a public research university that routinely applies for and receives patents related to technology developed in its labs. One patented technology developed there involves LED bulbs, and UC Santa Barbara believed multiple infringers were using the technology to make and sell lightbulbs through U.S. retailers. Rather than pursue each infringing manufacturer, UC Santa Barbara has targeted retailers, seeking to license the technology so that the retailer is free to sell bulbs that use the patented technology from any manufacturer. With the public backing of a litigation funder, the University was able to pursue the infringement claims and reinvest in education and research, free from concerns about misuse of public funds for litigation. The campaign is ongoing, but so far, several major retailers have licensed the technology.

i4i v Microsoft

There are several attributes of a potential patent case that funders might find attractive: a strong infringement read… a good “story” about the plaintiff… potentially high damages… a defendant that can pay. A classic example of such a case is i4i v Microsoft, a true David v Goliath litigation. i4i developed technology that gave users a better way to edit markup languages like XML. When Microsoft was asked to provide similar functionality on a federal project, Microsoft invited i4i to meet with its government sales team. After successfully landing the project with i4i’s help, Microsoft excluded i4i, but still used the patented technology. i4i could not afford to litigate against Microsoft, so it sought third-party funding to assert its patent. i4i obtained the funding it needed, and was ultimately awarded $290 million.

V. Future of Patent Litigation Funding

Increase in Litigation Tied to Patent Licensing Disputes

Michael Gulliford, of Soryn IP, has watched the patent litigation funding landscape shift over the past several years. He observes that, "unfortunately, in today’s post-patent reform world - which shifted quite a bit of leverage to infringers - many companies choose to copy a patented technology rather than pay to license it. Once that happens, the dispute almost invariably gets resolved in the courtroom. In a sense, when it comes to patent licensing, litigation has just become an expected, albeit expensive, part of the patent licensing business negotiation.”

Sonos, the company behind much of the wireless home audio revolution, is one public example that demonstrates even the most high-end technology companies may be forced to litigate their patents. Sonos claims that after sharing its technology with Google to further their shared technology integration goals, Google then launched its own competing product using Sonos’ patented technology. Unlike Sonos, many companies in a similar position are unable to afford the expensive litigation which forces larger companies to the license negotiation table.

Mr. Gulliford continued, “these days, if a company is doing something interesting from a technology standpoint, it can almost count on the fact that there will be some form of copying. Assuming the technology was patented, the resulting licensing discussions will most often lead to patent litigation, which could easily cost $5-20M depending on the scope of the dispute. Those expenses can cause quite a big hit to the income statement and that’s where litigation finance can really help.”

As the technology world moves toward further collaboration and integration between products, the table is set for licensing disputes to increase. And as patent litigation becomes an increasingly standard part of innovators’ attempts to license their technology, already expensive patent litigation is likely to increase as well. These increased costs will exacerbate the need for financial solutions like litigation finance.

Specialization In Patent Funding

As the litigation funding industry matures, one trend to watch is specialization by funders seeking to target patent litigation, with Fortress’ IP Fund and Soryn being prime early examples. Fund-level specialization provides strategic diversification options to investors, and facilitates the development of expertise in evaluating patent litigation investment opportunities. Firm-level specialization avoids some of the challenges faced by large-firm patent attorneys with respect to conflicts and plaintiff-side representation, and it presents opportunities for innovative litigation finance structures that help clients and the firm.

Permentum Capital is a litigation-finance firm that launched in January 2020. Permentum brings a fresh approach to litigation finance, one that simplifies the relationship between the funder and its counterparties. The company focuses on providing finance solutions for commercial disputes and purchasing assets where a legal outcome will be a significant driver of value. Permentum explores opportunities globally, with a heavy focus on legal disputes in the United States.